what is a required commercial invoice for item returns to amazon

Commercial invoices are a crucial part to international shipping, and there is no escape. There is frequently confusion about which documents you need to include to become your package to its final destination as smoothly as possible. In this article we explain what a commercial invoice is, why yous need this certificate and how to fill it out.

In this article, we volition respond the following questions:

- What is a commercial invoice and what is it used for?

- Create your commercial invoice using our template

- What is the departure between a commercial invoice and a CN22 or CN23 form?

- Paperless Trade for shipments via DHL Express or UPS

- How do you fill in a commercial invoice?

- Commercial invoice glossary

- How practice you add the commercial invoice to your shipment?

What is a commercial invoice and what is it used for?

A commercial invoice is a special export document that helps your packet get through community. A properly completed and correct commercial invoice for export helps customs government quickly decide which taxes and import duties utilize to your parcel. And this prevents delays.

A commercial invoice is a special export document that helps your packet get through community. A properly completed and correct commercial invoice for export helps customs government quickly decide which taxes and import duties utilize to your parcel. And this prevents delays.

In addition, customs officials tin can see whether your packet meets all the requirements and they tin can laissez passer on information (e.g. the recipient'southward tax liability) to the country of destination. If you fill up in this invoice correctly, there is a greater take a chance that your bundle will arrive on time. Packages within the EU do not require this special invoice. A list of EU countries tin be institute on the website of the Dutch Revenue enhancement and Customs Assistants . If in doubt, y'all can too consult the list of exceptions considering some countries or territories are function of the European union simply are non part of the EU community territory.

In addition to the commercial invoice, some international shipments outside the EU as well require a customs annunciation (CN22 or CN23) , a CP71 acceleration note, and perchance a Certificate of Origin (CO). This article will mainly discuss the commercial invoice for international shipping.

Create your commercial invoice using our template

Buying internationally is getting easier, but international shipping remains a scrap more difficult and filling in a commercial invoice is quite a flake of piece of work. Only we have made it a piffling easier with a handy template that helps you fill out this export document . This fashion you tin be certain that your invoice meets all the current requirements and that the details take been completed correctly. Fill up in all the details of your commercial invoice and then easily download your ready-made commercial invoice in PDF format.

What is the departure between a commercial invoice and a CN22 or CN23 form?

When sending an international package to a country outside the EU, yous often need several documents. Sometimes people are c onfused nigh the departure between the commercial invoice and the CN22 and CN23 documents mentioned above. This is not surprising: both forms requite customs regime information almost what appurtenances are entering and leaving a country. However, these two forms have piffling to do with each other and they should not exist mixed up. And so what exactly is the difference? First, permit's briefly discuss what each certificate involves:

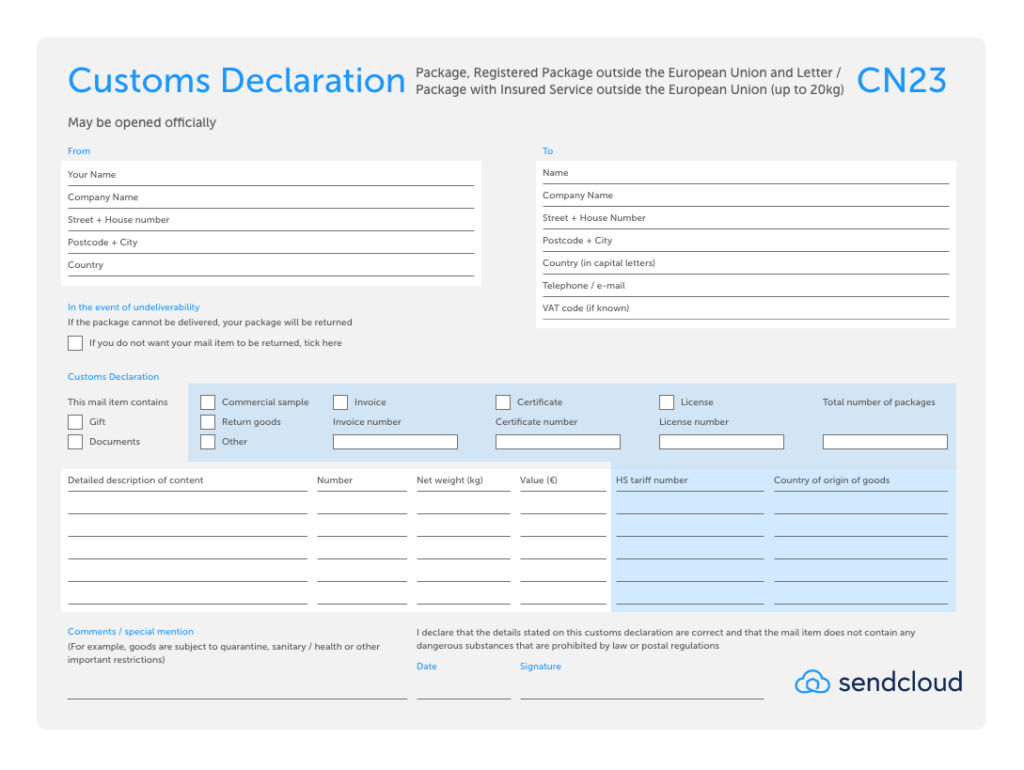

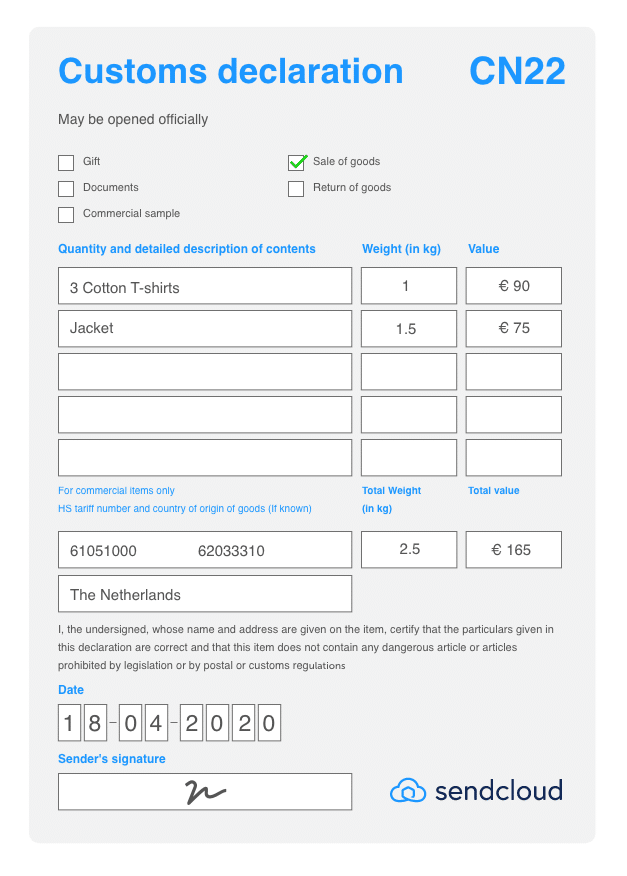

CN22 and CN23

A CN22 or CN23 form is a mandatory customs form that must be added to shipments exterior the EU. The form is mainly used for shipments that are transported past a postal company. The value or weight of the shipment determines whether y'all use course CN22 or CN23. The form contains data near the goods being transported and this information is used to determine whether revenue enhancement must be paid. A CN23 form is always accompanied past a CP71 dispatch note.

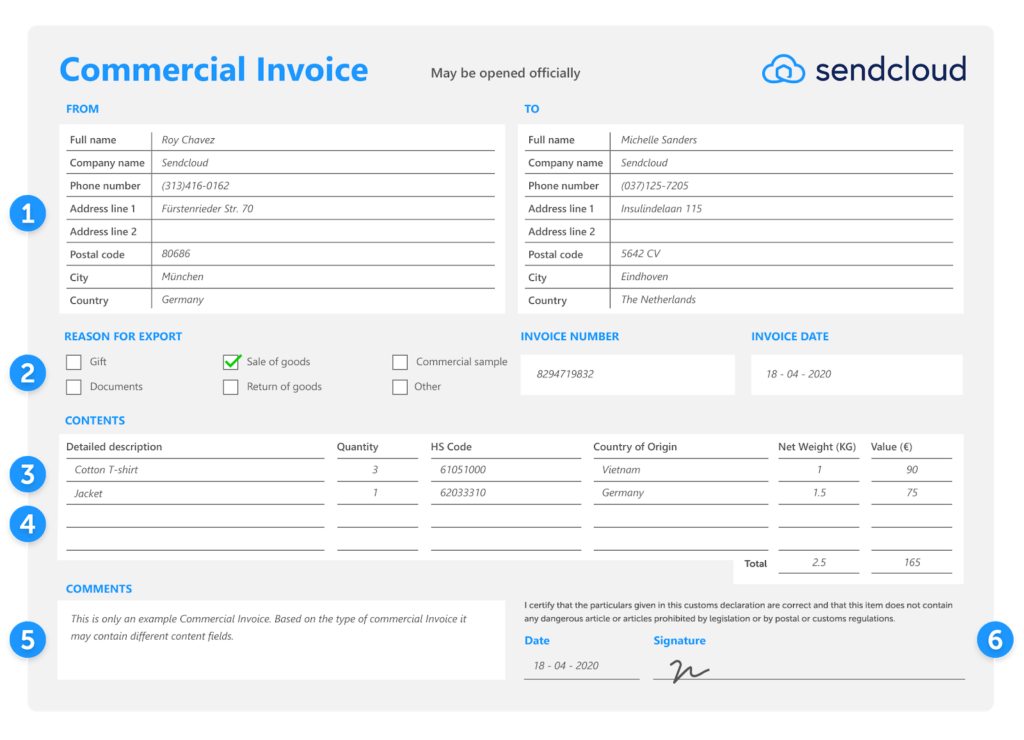

The commercial invoice

The commercial invoice is besides an export document that you add together to all commercial shipments outside the EU. Information technology is a bounden community document that mainly contains information about the contents of the package and the agreements fabricated (Incoterms), such equally who pays the community costs. Based on the commercial invoice, the customs regime determine whether import duties take to be paid on the goods.

A CN22 or CN23 document requires you to fill up in a chip more than information than the commercial invoice, merely the idea behind it is the aforementioned. Both documents provide data most the contents of the parcel so that customs authorities can decide whether the packet can enter the country, and who is responsible for which taxes and import duties.

Then when do you utilize a CN22 or CN23 form, and when practise you use a commercial invoice?

- If yous are sending a parcel to a land outside the Eu and using a postal service like PostNL (in holland) or Regal Mail (in the UK), employ the CN22 or CN23 customs form. The CN22 or CN23 certificate is used by the Universal Postal Wedlock and is therefore mandatory for postal services. You must also add a commercial invoice to this kind of shipment.

- If you are using a carrier such equally DHL or DPD instead of a post, y'all exercise not need to add a CN22 or CN23 form.

The main deviation is that a commercial invoice is ever required for all east-commerce shipments, and just parcels sent via postal services need the boosted CN22 or CN23 document.

However, to avoid delays, nosotros recommend that you lot e'er add both documents.

Paperless Merchandise for shipments via DHL Express or UPS

When you send via DHL Express or UPS, y'all can use 'Paperless Trade'. This means that customs forms are sent to the carrier electronically. Equally soon as you procedure your international gild, the customs forms are immediately forwarded. This non only saves you time, printing and costs, but it besides reduces the take a chance of documents beingness lost. Sendcloud automatically uses Paperless Trade when you ship outside the EU using DHL Express or UPS.

How to fill in a commercial invoice

What has to be on a commercial invoice? Although at that place is no standard format, the certificate must incorporate several fixed elements, such as details about the parties involved in the shipment and data about the appurtenances. Below you lot will find the near hard parts of the commercial invoice, and below that, y'all will notice an explanatory glossary.

Please note: A commercial invoice must always be in English.

What are you shipping: description of the article, number, weight, and value

Information technology may seem obvious, just describing the contents of the package is an important part of the commercial invoice. This gives customs authorities a articulate overview of what you are shipping. The description must explain exactly what you are sending, what the article is made of and, if applicative, what its purpose is. Practice this for each item separately. Community packages are oftentimes scanned, and you may be fined if the clarification does non lucifer the contents of the package. Therefore, it is very important to do this accurately.

Also state the number of items, the total weight, and the total value in euros of the contents of your package. Information technology is important that you determine the value accurately. Even a sample, gift or render shipment has a value.

HS code or commodity lawmaking

Every item in your package must have an HS lawmaking or commodity code. The Harmonized Organization (HS codes) classifies goods so that community authorities know which taxes, excise duties, and controls apply. It is of import that you enter the correct code as it determines the number of import duties or other taxes y'all must pay. Looking upwards the code tin can be difficult, but in that location are a number of means to detect your product's code.

The manufacturer of your product often knows its HS code. If yous don't accept this data, you tin can look upwards the lawmaking yourself. You tin apply Sendcloud's quick and easy tool to search for the right HS lawmaking. Or, become to merchandise tariffs on the customs administration website and click on the 'Nomenclature' tab. There yous will discover all the commodity codes. Do you demand more than aid? Then read the transmission on looking upwards article codes. Finally, you can contact the tax and customs agency in your country for more information.

Land of origin

In the 'country of origin' field, you state where your goods were produced. In some cases, y'all will need a CO document as an additional document. Some countries outside the Eu request this document for trade policy measures.

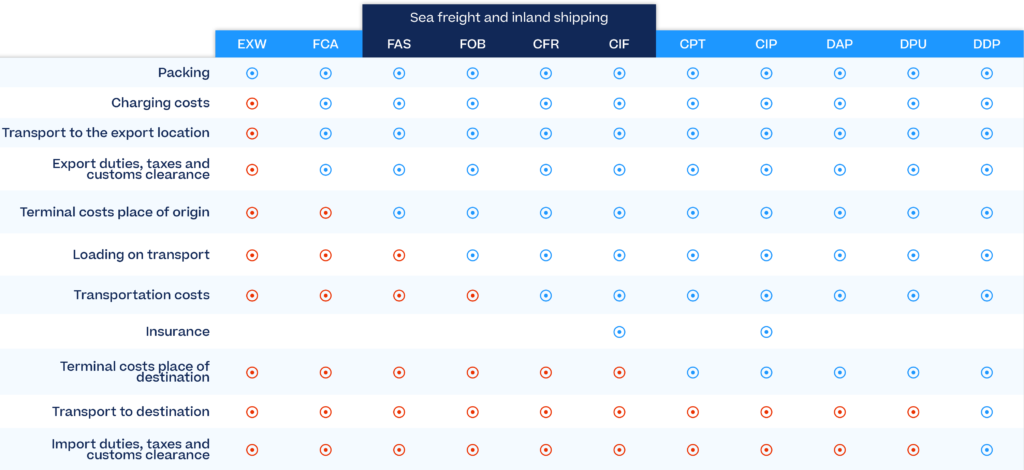

The Incoterms (or terms of sale)

The International Commercial Terms or 'Incoterms' are standardised international agreements on the transport of goods. The Incoterms clarify:

- Who is responsible for the shipping, insurance, import and customs costs of the shipment;

- Who takes care of the transport and to where;

- Who is responsible for the appurtenances at each phase of the shipment, including the point at which the risk and costs of delivery transfer from the seller to the heir-apparent.

Please notation that the carrier you have chosen also supports these Incoterms.

The Incoterms are updated every 10 years and and then have just been updated for 2020. The 2010 Incoterms remain in forcefulness, merely more and more companies will exist switching to the 2020 Incoterms. Read our update about the 2020 Incoterms here . The about mutual Incoterms are EWX (Ex Works), Pull a fast one on (Free on Board), CFR (Toll & Freight), DAP (Delivered At Place) and DDP (Delivered Duty Paid). If y'all don't know which Incoterm is best for y'all, we recommend y'all choose DAP. This ways that y'all as the seller pay the shipping costs, arrange the insurance and gear up the export documents. The recipient pays any import and community duties.

Commercial invoice glossary

We already mentioned that commercial invoices are e'er written in English. If you desire to create your commercial invoice yourself or are using a template and don't know what to make full in, you lot will observe a description of the most common terms hither:

- From: This is yous, the person sending the package.

- To: The name and address of the person or company you are sending the package to.

- Intermediate Consignee: If you are sending the bundle to an intermediary, fill up in the details of that person or visitor here.

- Engagement: The date you sent the package.

- Invoice Number: Your own invoice number.

- Customer PO No: Reference or social club number of your sale.

- Currency Used: The currency y'all used when filling in the document.

- Country of Origin: The state where your product comes from. In some cases, you must add a CO certificate.

- Reason for export: Tick everything that is applicable.

- B/L/AWB No: This refers to the transport document setting out the arrangements with the carrier. The carrier is frequently responsible for preparing this document.

- Final Destination: The terminal destination of your bundle.

- Export Route/Carrier: The shipping company you are working with or the road your bundle volition have.

- Terms of Sale: Better known equally the Incoterms.

- Terms of Payment: The payment terms between y'all and the seller (e.thousand. payment within 30 days of receipt, direct eolith).

- Terms of Freight: Freight conditions (e.g. prepaid, collect). You tin can also enter these terms and weather condition in the Terms of Sale or the Incoterms.

- No. of Packages: The number of packages you lot are sending.

- Comments: Infinite for aircraft or delivery instructions or other notes.

- Contents: A description of the articles you are sending.

- HS Code: The HS code or article code.

- Value: Cost per production.

- Net Quantity: Total number of products.

- Weight KG: Total weight of the package.

- Freight: If applicable, report the aircraft costs here.

- Insurance: If applicable, report the insurance costs here.

- Date and signature: Your name, signature, and engagement. Information technology may seem obvious, but your package will probably not be sent without your signature. So make sure to sign and date all your packages.

How to add together the commercial invoice to your shipment

Ordinarily you need to add 3 copies of the commercial invoice: one for the country you lot are exporting from, one for the country you are shipping to and one for the recipient. Put 2 of them in a packing list envelope on the exterior of the package and put the last commercial invoice within the bundle for the recipient.

Besides, make certain that your package meets these other requirements:

-

- The box in which you ship the package must exist sturdy plenty to withstand a autumn of 1.5 meters.

- The package must be filled with padding material. Due to censorship rules, you may not use newspapers for this purpose.

- The corners of the box must be reinforced with record.

Information technology is important that yous always go along a re-create of the commercial invoice and any CN22 or CN23 documents. If mistakes are fabricated in the handling of the shipment, you tin can sometimes face high customs fees. Be prepared for anything and keep a copy.

lipscomberaingerred.blogspot.com

Source: https://www.sendcloud.com/commercial-invoices-int/

0 Response to "what is a required commercial invoice for item returns to amazon"

Post a Comment